Technology Built By Investors

O'Shaughnessy Asset Management is a quantitative money management firm. OSAM has been managing client money since 2007 with team members managing our strategies back to 1996. The Canvas® platform is our newest client-focused investing solution and service of O’Shaughnessy Asset Management, L.L.C.

The future of investing lives at the intersection of research and technology. Our team has spent decades building both and is turning our systems inside out to give other professionals access to build and implement their own strategies. We will keep improving every aspect of Canvas so your business and your clients' portfolios will, too.

Total Customization That Scales

Your firm's existing investment philosophy + client-specific adjustments.

Client-Specific Strategy Design

Start with strategy templates built to express your firm’s core investing tenets, then tailor a fingerprint portfolio for each client based on their circumstances and preferences.

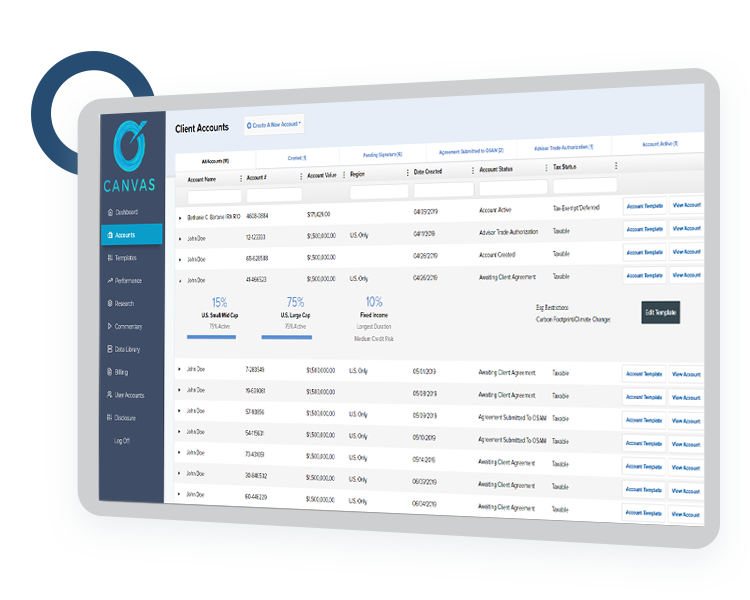

Deep Operational Efficiency

Digital paperwork, easy onboarding, and efficient dashboards. Everything is built to be scalable for advisors. Canvas is your investing operating system.

Solve Unique Problems for Clients and Prospects

Manage single stock, portfolio, and career risk exposures. Optimize taxes. Adjust holdings for the investors’ values.

what strategies will you design?

In the past, advisors had to mix off-the-shelf products that weren't built with any one client in mind. Overlapping positions, unintended exposures, and high active costs are now a thing of the past. Control everything and build the most efficient strategies possible using these dimensions of customization:

Dimensions of Customization

Asset Allocation

Select weights to stocks and bonds, including region and market cap segmentation.

Factors

Most factor strategies are watered down and based on generic factor definitions. Our team has spent decades honing and improving factor strategies. Build our core or single factor-focused exposures into your Canvas portfolios.

Direct Indexing

Choose what percentage of the portfolio to invest in US and International indexes. By investing directly in the underlying positions instead of funds or ETFs, you can harvest tax losses for clients and customize their holdings at the position level.

ESG

Control for climate change, deforestation, pollution, water stress, data privacy, diversity, labor rights, corruption, gender diversity, and/or governance structure. Choose only issues relevant to the client and see the impact in real time.

Tax Loss Harvesting

Across every trade, we optimize for the best after-tax results. This includes automatically harvesting tax losses throughout the year. You can even control how aggressive to be in harvesting losses by setting tracking error levels at both the firm and client level.

Position Level Customization

Never before could you control every direct index, factor strategy, or ESG strategy at the position level. With Canvas you can do it easily and in one spot. Exclude individual stocks, industries, sectors, and other categories.

Fixed Income

You select credit and duration risk in a simple 5x5 grid. We then use our optimizer to build a smart fixed income allocation with low cost ETFs.

The Next Step in Investing Technology

OSAM's investment philosophy, process, and experience in building portfolio management tools converge in the Canvas platform, delivering the ultimate advisor/client experience.

-

Index Funds

Diversified Beta at a Low Cost

1970s

-

ETFs

Access to Cheap Beta

1990s

-

Tax-loss Harvesting

Introduction of tax optimization for clients

1990s

-

Robo Advisors & PM Software

Brought simplification and improved operational efficiency to advisors

2000s

-

The future in investing technology.

.png)

.jpg)